Sales Tax

We have prepared this sales tax policy statement to explain to you when, why and how we collect sales tax on your purchases.

- For deliveries within Texas: We collect 8.25% sales tax in Texas where we have our physical presence. Per the Texas Comptroller, shipping is taxable.

- For deliveries outside of Texas: We do not collect sales tax on products and shipping in any other states because we are not required to collect sales or use tax in other states.

FOR OUR TAX-EXEMPT CUSTOMERS IN TEXAS

We do not collect sales tax if we have your exemption certificate on file. You can chose a one-time, single purchase usage of your sales tax exemption certificate, or blanket submittal for future orders:

ONE TIME SUBMITTAL FOR A SINGLE PURCHASE

If you only want to submit your exempt certification information one time for a single purchase, you can do this without registering as a user on our website, and check out as a guest. Your sales tax exemption will be still be applied even with a guest checkout, but only for the single purchase*.

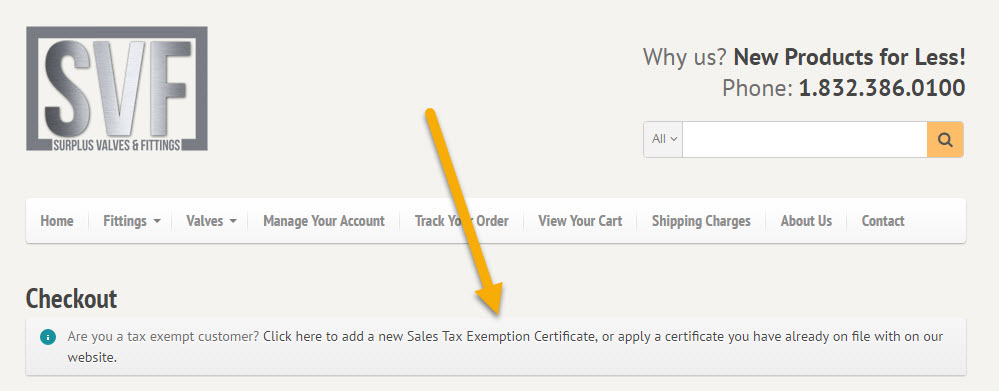

You provide your sales tax exemption certificate details when you get to to the Checkout page. Simply click the button at the top of the Checkout page:

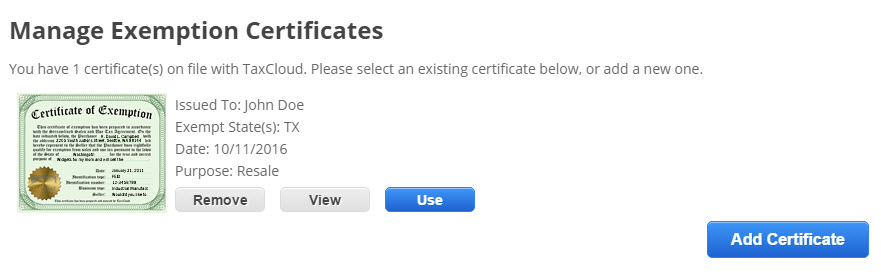

In the pop-up window that displays, click the “Add Certificate” button and enter the required information. Once you’ve filled out all the fields, click the “Save Certificate” button. Sales Tax will then be removed from your order.

* NOTE: Remember, follow the above instructions if you want to use your sales tax exemption one time for a single order. If you think you will make future tax-exempt orders on our website, follow the below instruction!

BLANKET SUBMITTAL FOR FUTURE PURCHASES

To upload your exempt certificate for “blanket” coverage on future orders, you must fist create an account on our site. This will allow us to retain your uploaded exempt certificate and associate it with your account.

Once you have created an account, you can continue with your purchase and when you get to the Checkout page, click the button on the top of the Checkout page as per the screenshot above. In the dropdown for Certificate Type, select “Blanket Purchase”:

(This option in the dropdown is only visible when you have previously created an account on our website.)

Fill out the form otherwise, and click the “Save Certificate” button when you are done, and sales tax will be removed from your order.

You can add more than one sales tax exemption certificate if you have multiple certificates.

Next time you visit our site to make a purchase, first log in with the account you created previously. When you go to check out, click on the tax exempt button at the top of the Checkout page as before, and now you will see your previously uploaded certificate(s). Click the “Use” button by the certificate you want to use for your new purchase:

In this screen, you may also remove or add sales tax exemption certificates.

That’s it! If you have any questions or problems, don’t hesitate to contact us!

IMPORTANT NOTICE: Even if we do not collect sales tax from you, you may owe sales tax on your purchase. Unless you live in Alaska, Delaware, Montana, New Hampshire, or Oregon, your state most likely requires purchasers to report and pay tax on all purchases that are not taxed at the time of sale. The tax may be reported and paid on your individual income tax return or by filing a consumer use tax return. For more information, please visit your state’s department of revenue website.